What is all of this going to cost?

It sucks, we get it. And the unlimited different ways that merchant accounts and 3rd party payment processors find to hide their various rates and fees only makes it worse. But we’re here to help you cut through the nonsense.

The fact is, you’re gonna have to pay to process credit and debit cards. There is no way around that. But what you pay is heavily dependent on how much homework you do and how well you negotiate your rates & fees with the processors.

The more payments you process, the lower the rate you can negotiate. Obviously, Walmart is in a better position than you to negotiate lower rates, but even they have to pay the banks. In all likelihood though, you should expect the total cost to be somewhere between 1.75% and 3.50% of your gross credit/debit card payments, depending on a number of factors.

Oh look – it’s Rates and Fees! They look so harmless, so why am I not happy to see them?

“A Number of Factors” you say?

Yeah, that’s right. We’ve already covered how size affects you, with the largest retailers able to negotiate more favorable rates. But there are quite a few other things that affect your payment processing rates and fees as well:

| Type of Business | Banks score different industries higher or lower based on risk factors, so you’re automatically placed in a risk bucket. |

| Card Present? | Do you physically see the card that’s being used for payment? If not, you’re likely to pay higher rates for “card not present”, this includes online eCommerce sales and phone orders. |

| Payment Volume | As mentioned earlier, the more money you make for the banks, the better terms you can negotiate. |

| Type of Card | Your rate is not the same for every card. Debit cards are the cheapest to process. American Express costs more than a Visa or MasterCard. However, even different MasterCard’s have different rates depending on if it’s a rewards card, business card etc. These all include different assessment & interchange fees, as we’ll explain later. |

| Payment Processor Markup | Each processor will add their own markup, and this is your easiest fee to negotiate. |

| Scummy Fees | Payment Processors need to make a profit too, and it’s fine if these fees are transparent, but some processors will hide an assortment of unnecessary fees in the fine print. So we refer to these as scummy fees since that’s what they are. Don’t do business with scum bags. |

| Additional Services | If you’re paying for point of Sale (POS) software or a payment gateway through your payment processor, you’ll have additional fees for this. |

OK, so what are Interchange Fees?

Interchange fees make up around 90% of your total payment processing fees, so if you only take away one thing from this, take away an understanding of interchange fees. So what are they? Well, in a nutshell interchange fees are the wholesale cost to process card payments.

What that means is, they’re NOT negotiable. These fees are set by the credit card networks like Visa, MasterCard and American Express, so the merchant account provider (ie, the bank) has no control over it.

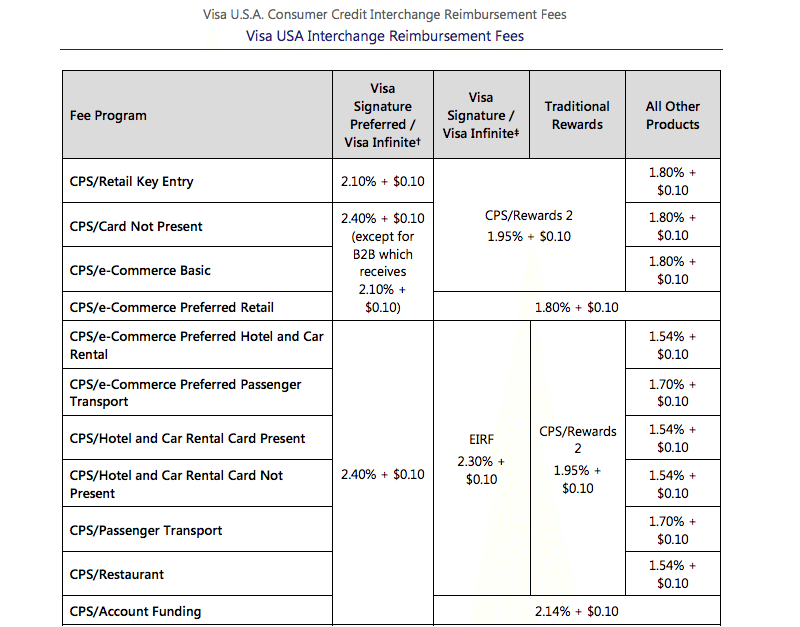

You can actually view the Visa USA Interchange Reimbursement Fees right here.

In case you don’t feel like wading through that monstrous PDF, here’s the highlights:

Again, just to reiterate – these fees above are not negotiable. If you want an easy way to tell if a merchant account provider is dishonest, ask them if they can lower these fees. If they say yes, run away.

Got it, so what are Assessment Fees

Assessment Fees are also wholesale costs for processing card payments, so they too are non-negotiable. However, they’re much smaller than the interchange fees and are generally lumped in with interchange fees even though they are technically different.

Basically, if you see terms like wholesale-plus, interchange-plus or cost-plus those are just different ways of saying the fee includes interchange & assessment fees. This is done to separate out the non-negotiable fees from the fees tacked on by your merchant account provider.

Interchange & Assessment Fee Examples

So basically you’ll end up with a wholesale cost stated in terms of a percentage + a per transaction fee. So for instance, the wholesale cost of an eCommerce transaction on a basic credit card will be 1.80% + 10 cents per transaction. That’s the part that is non-negotiable.

Whatever you pay above that is the markup (or vig, as my bookie calls it).

Common Interchange + Assessment Fees

*Card Present = card swiped or dipped in terminal

*Card Not Present = eCommerce, phone order etc

| Card Present | Card Not Present | |

|---|---|---|

| Basic Credit Card | 1.51% + $0.10 | 1.80% + $0.10 |

| Signature/Traditional Rewards Card | 1.65% + $0.10 | 1.95% + $0.10 |

| Preferred Rewards Card | 2.10% + $0.10 | 2.40% + $0.10 |

| Debit Card (Small Bank) | 0.80% + $0.15 | 1.65% + $0.15 |

| Debit Card (Big Bank) | 0.05% + $0.21 | 0.05% + $0.21 |

So with all of these different rates depending on the type of card used, how do you know ahead of time how much it’s going to cost to process card payments? Well, you don’t. Complicating things further, merchant account providers will often obscure their markup by providing tiered pricing in their quotes, and those tiers don’t exactly match up with the interchange table above. The only way to get a true comparison between merchant account providers is to get an interchange-plus quote.

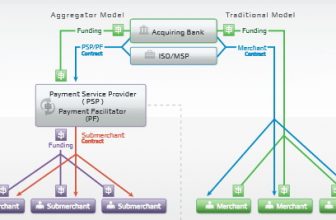

Complicating things further still, is if you’re using a Payment Service Provider (PSP) instead of going direct to a bank for your own merchant account, they’ll likely provide a blended rate (AKA a flat rate). They know what percentage of your transactions are likely to be each card type so they blend those together, tack on their markup and give you one simple rate/fee such as 2.9% + 25 cents per transaction.

Is that it

Weeellllll, not quite. That’s just the transactional fees. You will also likely end up with scheduled fees and one-time fees as well, depending on the payment processor or merchant account you choose.

- Scheduled Fees:

- Monthly/Annual Fees

- Monthly Minimum Surcharges

- PCI Compliance Fees

- Equipment/POS Warranty Fees

- Incidental (one-time) Fees:

- Application Fee

- Setup Fee

- Chargeback Fees

- Early Termination Fees

Some of these fees are better than they used to be, since the FTC passed some rules awhile back to protect consumers and merchants alike. That being said, it’s a lot to keep track of but we hope this helps clarify things a little bit.