There are numerous avenues for small business owners to pursue investments in their business. Traditional sources include everything from maxing out personal credit cards, borrowing from friends & family or applying for small business loans at a local bank or credit union. But there are other, more creative approaches that can be taken now thanks to advances in technology and changes in government regulations…and that’s what we’re going to cover here.

What is equity crowdfunding?

Also known as crowd equity, crowd-investing, regulation crowdfunding and other variations – equity crowdfunding is simply a way for small business owners or entrepreneurs to get financial investments in their business in exchange for equity in that business. Basically, investors exchange cash for a small piece of the business.

If this doesn’t sound new, it’s because the idea has been around forever, but government regulations forbade it for anybody but the largest accredited investors (basically someone with a net worth over a million, with a few exceptions). As a result, small businesses were unable to attract this much needed cash since not everybody is a close friend with a multi-millionaire and larger investors are attracted to larger opportunities. That’s all been changed now.

All these people want a piece of the action

Title III of the JOBS Act

The Jumpstart Our Business Startups (JOBS) Act was signed into law in 2012, but Title III of that Act – which applied specifically to Crowdfunding, did not go into effect until this year. What that means for the rest of us is you can sell tiny pieces of your company (or project, idea, etc) on a centralized platform, allowing you to attract potential investors who know nothing about your business, but who are willing to give you money for a small piece of the pie.

How Equity Crowdfunding for Small Businesses Works

Title III of the JOBS Act did two very important things. First, it made it legal for non-accredited investors to buy into small and Medium-sized businesses (SMB’s). That made the pool of potential investors in your business exponentially larger. Second – and this is the big one, it made it legal for crowdfunding platforms to spring up and act as intermediaries between investors and small business owners.

Think of these crowdfunding sites as something like eBay, except you’re not selling the junk from your garage, you’re selling a piece of your business. The platform facilitates all of the things that are a pain to deal with and also provides details on investors and business owners to help determine who is and isn’t trustworthy or worth investing in.

Think of these crowdfunding sites as something like eBay, except you’re not selling the junk from your garage, you’re selling a piece of your business. The platform facilitates all of the things that are a pain to deal with and also provides details on investors and business owners to help determine who is and isn’t trustworthy or worth investing in.

If you’ve ever used eBay, you know how their feedback system works. Being able to read about the transaction history and other pertinent details of the other party is extremely valuable. Unfortunately, getting thousands of dollars in exchange for a piece of your business is a lot more complicated than selling your old baseball cards, so the bigger crowdfunding platforms facilitate a lot more than just the reputation of each party.

What Do The Equity Crowdfunding Platforms Actually Do?

So we’ve already pointed out the huge pool of investors that these crowdfunding platforms put at your fingertips. And they all do a good job of collecting information on potential investors to make available to you so that you can properly vet them. But they also help with the Form C, Blue Sky paperwork and other necessary regulatory paperwork. Several of them also offer help with putting together your pitch, communications with the investors, shareholder services and more. Finally, most of them offer ongoing filings for you for a nominal fee.

Which Equity Crowdfunding Platform Should I Try

We’re not going to make a recommendation on which one to use, that’s where you’ll just need to do your homework. We can tell you who the biggest players are though, and then you can compare fees (normally 3-% of amount raised), ease of use, pool of investors, and reviews of equity crowdfunding platforms.

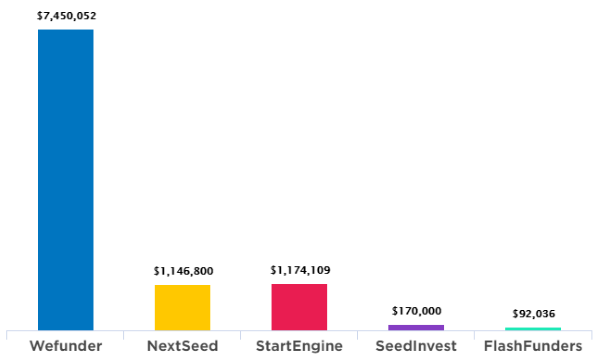

This is a very new industry (just a few months old) so expect these stats to change, but as of this writing there has been around $10 million raised so far for various businesses, and that number is growing daily. The big 5 platforms are WeFunder, NextSeed, StartEngine, SeedInvest and FlashFunders.

As it stands now, WeFunder is by far the biggest, but that doesn’t mean it’s the best, or even that it will be the biggest a year from now. In fact, StartEngine has more deals in the pipeline and NextSeed has a higher success rate. So do your own research, our goal is just to point you in the right direction, not to give you financial or legal advice.