We’ve seen a huge shift into a new payment option over the last year, into a credit model known as “BNPL”. BNPL is an acronym for Buy Now, Pay Later. If it sounds like the old school layaway of years past, that’s because that it is similar in some ways. But there are some key differences.

The old layaway model was popularized by larger national chains during the Great Depression as a way to help extend informal credit to their customers who couldn’t afford to pay a large lump sum for purchases. It enabled lower income people to put money down on a purchase and pay it off over time. The advantage for consumers was that people who might not feel like they could save up for major purchases, could put some money down on an item and the store would hold it in inventory for them until they could pay it off. This not only locked in the price on an item and guaranteed it would still be in stock, but it was also interest free (minus a typical flat fee).

As credit cards became available for even the lowest income earners, the need for this system died out. With credit cards, a customer could take the item home with them the same day even if they didn’t have the money now. This freed up inventory space and eliminated administrative and accounting headaches for retailers. They no longer cared if you paid your credit bill, once you made the purchase on credit the transaction was over.

What Does Buy Now Pay Later (BNPL) Mean For Businesses?

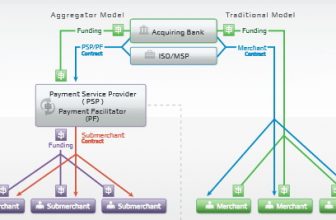

BNPL is similar to digital layaway in that it extends credit for customers who otherwise might not be able to make a purchase. However, unlike layaway of days gone past, the customer gets the item immediately. Also, the business is relieved of the administrative and accounting headache of dealing with partial payments on an item. However, there is some initial setup required for merchants to take advantage of BNPL payment options for their customers.

BNPL providers actually make money by charging a fee to the merchants, rather than the consumer. Because of this, it’s actually more like factoring since the business is effectively selling its accounts receivable to the BNPL lenders for a fee. This has lead to many younger consumers adopting it as a method to pay since it avoids (in theory) the onerous interest charges and fees they associate with credit card usage.

Recent studies show around 1 in 8 shoppers under 40 have used BNPL, and that number is continuing to grow as Millennials and Generation Z consumers look for alternative payment models that are flexible and digital. With wide adoption like that and a preference of these shoppers to buy from businesses that support these payment methods, a business should consider adopting a BNPL option into their payment processing.

Downsides/Risks With BNPL

Capital One, one of the largest credit card companies in the world recently announced that they would halt all BNPL transactions on their cards. Since Buy Now Pay Later is effectively Point of Sale (POS) lending, it gets around most of the established lending laws and regulations that protect consumers and businesses in credit transactions. Because of this, Capital One made a business decision to no longer support it. Due to their size and influence, this could lead to other financial institutions following suit, or more likely there will be BNPL regulations coming from Congress in the near future.

How Much Does It Cost To Offer BNPL To Customers

The claim made by BNPL providers is that offering BNPL to your customers will result in an increase in sales. There is evidence of this, at least in short term purchases. However, the fees will generally cost the business more than credit card fees do, typically around 3-6% of the purchase price. Each of the major players have slightly different offerings in how the merchant can use them but in all cases expect an added layer of complexity and cost. However, the increase in sales may be worth it and many of the largest businesses offer at least one of the major BNPL options in their checkout process.

Largest “Buy Now Pay Later” Providers

AfterPay is currently the largest player in the BNPL space. Based in Australia, they have processed over $1 Billion in US transactions in the most recent fiscal year. Recent financial disclosures indicate they generate around 75% of their revenue from merchant fees, with the other 25% from consumer late fees.

AfterPay is currently the largest player in the BNPL space. Based in Australia, they have processed over $1 Billion in US transactions in the most recent fiscal year. Recent financial disclosures indicate they generate around 75% of their revenue from merchant fees, with the other 25% from consumer late fees.

Update: In August 2021 Square agreed to purchase Afterpay for $29 Billion. Expect more of this consolidation in the BNPL space, which will ensure these sorts of payment options (and the higher merchant fees that come with it) are more available for customers.

Affirm is US based and is partnered with Shopify online and even offer in-person payments through their partnership with Walmart. They also recently announced a partnership with Home Advisor to enable consumer the ability to Buy Now Pay Later on hem improvement projects.

Affirm is US based and is partnered with Shopify online and even offer in-person payments through their partnership with Walmart. They also recently announced a partnership with Home Advisor to enable consumer the ability to Buy Now Pay Later on hem improvement projects.

Klarna is a Swedish BNPL provider who essentially invented the BNPL model in 2003 when they decided to form Klarna based on “a factoring model brought to eCommerce”. They claim 41% increase in average order value and 30% increase in conversions for merchants how sign on.

Klarna is a Swedish BNPL provider who essentially invented the BNPL model in 2003 when they decided to form Klarna based on “a factoring model brought to eCommerce”. They claim 41% increase in average order value and 30% increase in conversions for merchants how sign on.

Paypal recently got into the BNPL space when they rolled out their “Paypal Pay in 4” program. Like most Buy Now Pay Later options, the consumer chooses to pay in 4 installments during the checkout process if the merchant has PayPal as a payment option. With PayPal’s established presence on most websites, this gives them a big advantage as they look to take market share away from the other major players in the BNPL space.

Paypal recently got into the BNPL space when they rolled out their “Paypal Pay in 4” program. Like most Buy Now Pay Later options, the consumer chooses to pay in 4 installments during the checkout process if the merchant has PayPal as a payment option. With PayPal’s established presence on most websites, this gives them a big advantage as they look to take market share away from the other major players in the BNPL space.

How To Offer BNPL Options For Your Customers

To get signed up, you’ll want to do your research on each of the providers to decide which one makes the most financial sense for your business model. Set up is easy as they all integrate with Shopify, WooCommerce and most other large shopping cart solutions. Typically this means you can plug them right in to your site once you sign up as a merchant. They all make big claims on how much they’ll increase Average Order Value, Conversion Rates, and revenue in general but there are no guarantees so you’ll want to keep a close on eye on how your revenue and projections are affected before and after to determine if the cost is worth benefits.