Processing Credit Card & Debit Card Payments

The subject of payment processing is a big one, as there are many ways to pay for goods and services.

Cash is still holding strong, but as more commerce moves online it becomes less relevant. Checks aren’t used in personal transaction very often anymore, although many businesses still use them. ACH transactions are popular for paying bills, but not in commerce. Even alternative currencies (sometimes referred to as cryptocurrencies) like Bitcoin and Ethereum have their place, but in terms of volume it’s still comparatively small.

The fact of the matter is the real bulk of payment processing is done for credit card and debit card transactions. The majority of consumer transactions use credit/debit cards and that number is even higher online. So we’re going to focus on that for now.

Processing payments used to be a wee little bit simpler

“Why Do I Need To Accept Credit/Debit Cards?”

For most businesses this question doesn’t even come up, but we have seen it for some smaller mom & pop type shops. Generally the issue raised is the comparative cost and complexity of processing credit and debit transactions. So we’re going to break down this complicated subject to make it more accessible to small business owners.

Types of Payment Processing Accounts

Alright, so you need a payment processing solution – what are your options? Well, there are two different types of accounts for accepting credit/debit payments: merchant accounts and payment service provider accounts.

Merchant Accounts are for, well, merchants. If you own a business, you are a merchant. Merchant accounts are your best bet if you are processing any individual transactions larger than $300, or if you plan on processing more than $10,000/per month in transactions. At these usage levels, a merchant account will give you the best rates.

When you set up a merchant account you enter into an agreement with the bank that will be processing your payments, so you’ll be able to rest assured that you have a rock solid, dependable payment processing solution. However, at lower volumes you’ll want to consider a PSP account.

Some examples of a standalone merchant account would be Helcim, Dharma, FattMerchant etc

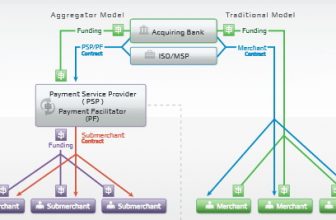

Payment Service Provider (PSP) Accounts are a lower cost option that will save you money if you’re not planning on processing payments at the levels described above. PSP’s are also sometimes referred to as third-party processors or aggregators.

The PSP essentially acts as the middle man between you and the bank that actually processes the payments. The way they work is a PSP will set up its own account and funnel your payments and those of countless other smaller merchants like your self through their account, to be processed by the actual bank.

PSP’s are often slightly more expensive than your own merchant account per transaction, but because there aren’t monthly fees or contracts for you to deal with the overall cost of processing transactions through a PSP will be cheaper if you have fewer transaction or need to just accept sporadic payments.

An example of a PSP account would be something like Paypal or Square

The key to remember is either one of these options will process credit card and debit card transactions for you.

A general rule of thumb if you’re unsure which is which, is if they charge you a monthly fee is probably a merchant account, and if they don’t it’s likely to be a PSP account.

Merchant Account vs Payment Service Provider Account

| Merchant Account | Payment Service Provider | |

|---|---|---|

| Cost | Lowest for mid- or high-volume businesses, usually negotiable | Lowest for lower-volume businesses, usually nonnegotiable |

| Setup Time | Several days | Generally instant |

| Value | Sometimes includes software or hardware at no additional cost | Always includes basic business software at no added cost along with low-cost hardware |

| Reliability | Account terminations and funding holds are uncommon | Account terminations and funding holds are somewhat common and difficult to predict |

| Support | Usually high-quality, including dedicated account manager | Usually self-service, with little or no quality phone-based support |

| Versatility | Works with a variety of third-party hardware and software | Works with a limited selection of usually proprietary hardware and software |

| Commitment | Should have no early termination fee, but might have setup/closure costs | Almost never has an early termination fee |