“The whole duty of government is to prevent crime and to preserve contracts.” ~Lord Melbourne. Yeah but this contract is so important it has a $3 padlock on it.

How to Negotiate Merchant Account Contracts

Before we get into the details, this is where we should point out that it might make sense to prioritize merchant account service providers with a solid reputation rather than trying to save a few bucks. Consistency and transparency are worth something, especially if you’re not someone who enjoys reading the tiny print in your spare time. The fact is, there are some merchant account providers who don’t force you to negotiate every little detail, saving you time and hassle.

Regardless of which merchant account service provider you use though, you’re going to need a decent understanding of payment processing contracts. Whether you’re looking to negotiate better terms or just want to understand what you’re signing up for, we’ve got you covered.

Step 1 – Get an Interchange-Plus Quote

The only way to effectively negotiate with merchant account providers is to request an interchange-plus quote so that you’re doing an apples to apples comparison between payment processing providers. This forces the salespeople for the providers to separate out their markup from the actual wholesale transaction costs. That doesn’t mean you always want to go with the cheapest option, but at least you’ll have the actual numbers to be able to make an informed decision.

Step 2 – Examine the Fees to Calculate the Effective Rate

So now that you’ve got the fees separated out you need to differentiate between “incidental fees” and “scheduled fees”. Incidental fees are one time fees and ARE NOT part of the markup. These include things like application fees, setup fees, early termination fees and chargeback fees. Scheduled fees ARE part of the markup. These include things like monthly/annual fees, PCI compliance fees, monthly minimum surcharges and Address Verification Surcharges (AVS) for example.

* Just a side note about Address Verification Surcharges (AVS) – many merchant account providers will get sneaky and add a per transaction cost for these. If you’re doing a lot of card not present transactions, such as eCommerce, mail order or phone orders, these charges can add up.

Step 3 – Calculate the Effective Markup Rate

Now that you’ve got all of the various fees broken down and sorted out, you can calculate the Effective Markup Rate. There is no more important number if you’re rate shopping, so you’ll want to get this right. So when you’re shopping around for a merchant account you’ll be given a quote that includes something like the following:

- Interchange-Plus: 0.25% + $0.20

- Monthly Fee: $12

- Annual PCI Compliance Fees: $60

- Monthly Gateway Fee: $15

So now you need to make a few estimates on your usage that you’ll plug-in to determine estimated cost. For easy math let’s just say you expect to process $25,000/month and your average credit card transaction size will be around $50.

| Math Instructions | Example Calculations |

|---|---|

| #1 – Multiply your expected monthly volume by your markup rate | 25,000 * .0025 = $50 interchange-plus markup |

| #2 – Divide your monthly volume by the average transaction size to determine average number of monthly transactions | 25,000 / 50 = 500 transactions |

| #3 – Multiply average number of transactions by the per transaction fee (from interchange-plus quote) | 500 * 0.20 = $100 monthly transaction fees |

| #4 – Add up scheduled fees (divide by 12 for annual fees) | $12 + $15 + $5 = $32 scheduled fees |

| #5 – Add totals from Steps 1, 3 and 4 | $50 + $100 + $32 = $182 monthly cost above wholesale |

| #6 – Divide your monthly cost above wholesale by monthly card payment volume to get effective markup rate | 182 / 25,000 = 0.0073 |

And there’s our magic number! Multiply by 100 to give you the percentage and we have an Effective Markup Rate of 0.73% equaling $182 in monthly fees that are negotiable. The sales rep will not do this math for you, but with this formula you can easily determine the actual cost for all merchant account providers.

Step 4 – Assess the Overall Value

With this formula in hand, you’re already miles ahead of most people that the merchant account sales rep talks to. But it’s important to realize that cost isn’t the only thing that matters. If some guy at the flea market offered you a set of tires for $50 you’d probably think twice, right? Value includes more than the cost, so you need to look at the whole picture.

For instance, if you’re processing $25,000/month and you get a few different quotes you may end up with something like this after doing the math:

- Provider #1 – 0.73% Effective Markup Rate with nothing additional

- Provider #2 – 0.80% Effective Markup Rate, but includes payment gateway and virtual terminal

- Provider #3 – 0.90% Effective Markup Rate, but includes gateway, virtual terminal and shopping cart integration for your website

If you don’t need these additional services, then it might make sense to go with the first option, but if you do then you’ll need to figure out those additional costs as well. Even though provider #3 has the highest Effective Markup Rate, once you factor in the cost of the other things included it’s possible that you’d be better off going this route. It really depends on what additional services you need and how much flexibility you want.

Also, don’t forget the importance of customer support. This is harder to quantify with a formula, but when you’re deciding between providers you will definitely want to do your due diligence on their reputation for things like customer support and deposit times.

Step 5 – Review Contract Termination Terms

Reading contracts sucks. Of course you should read the contract, but we know you probably won’t read the whole thing. Most of the contracts in the industry are pretty standard anyway, but you should absolutely pay close attention to the section that covers termination of the merchant account contract. You very much want an early termination fee waiver, which effectively makes your contract month-to-month.

Without an early termination fee waiver, you’ll want to watch out for an auto-renewal clause. This means that your contract – which normally is for a 3-year term, will automatically renew. That also means that if there is an early termination fee it will also auto-renew even though you have satisfied the initial terms of the contract.

These are nothing compared to liquidated damages though. If you see anything related to liquidated damages, do not sign the contract. Period. Liquidated damages are a type of early termination fee that allows the merchant account provider to collect thousands of dollars in damages from you based on projected revenue losses due to your early cancellation. This is never a good idea. Ever.

Shop Around for the Best Merchant Account Service Provider

Alright, so now that you know what to look out for you can go get a few quotes. You should get at least 3 quotes, and the best part is once you do the math and determine the cost you can take that quote and shop it around for a merchant account service provider to match that price. If you prefer one provider but they don’t have the lowest price, they will very likely match a competitor quote. This gives you the best of both worlds, the provider you want with the lowest price.

Sidenote: one thing to keep in mind while shopping around is to completely ignore high pressure sales tactics or “limited time offers”. There is no such thing as a limited time offer in merchant service sales. If they offer you a deal today, they will still give it to you a week from now to get your business.

Never Agree Immediately

Be patient. There will always be limited time offers, and you’re entering in to a contract so make sure you don’t agree to the first offer. If you sense urgency from the salesperson that’s because they are in a hurry, but there is no reason for you to be. In fact, you should start off your discussion with them by explaining that you don’t respond well to high pressure sales tactics and will take your business to their competitors just on general principal.

That’s not to say that every merchant account provider is out to scam you or pressure you, it’s just that they want to make money just like you do and this is how they make their money. That’s fine, but you owe it to yourself to ensure you get the best deal you can get.

Going Direct to the Big Boys?

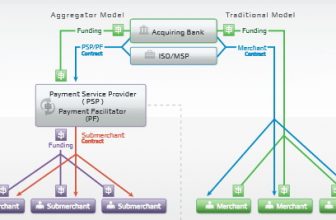

At the top of the merchant services pyramid is the payment processor and the bank they’re partnered with. Sometimes this is the same company, sometimes not. The payment processor is who handles the transaction details and the bank is who moves the money around. Whether it’s a single company serving both roles or a processor/bank partnership, you can think of this collectively as the backend payment processor. There aren’t many backend payment processors in the world, and although you might think you can save money by going direct to them, you’d be wrong.

Merchant Service Providers (MSP’s) also referred to as Independent Sales Organizations (ISO’s) are who you are likely to deal with. Although they occupy a lower level on the food chain, the services they provide are an added value and one that is definitely worth it for small and medium sized businesses. They provide merchant account contracts and customer support for the backend payment processors, which enables you to enter into agreements with the credit card networks. Most (probably all) merchant account providers you’ll talk to fall into this category.

So although you might think intuitively that you’ll save money by cutting out the middleman, the reality is different. In actuality, when you enter into a contract with a quality merchant service provider you’ll get a standardized contract and pricing package that is transparent and fully disclosed. They’ll also most likely include additional products/services that add value for you that you wouldn’t get by going direct to a backend payment processor.

So in the end, by going through a merchant service provider you’ll get all of the safety and security provided by the big backend service providers with the extra attention and customer support that you can only get from a dedicated merchant service provider. There are some less than savory merchant service providers, so you’ll need to make sure to read our reviews and do your homework. But as long as you enter into an agreement with one of the better ones you’ll end up with all of the tools you need for your payment processing.