One question we often get is people asking us what the difference is between a PSP and an ISO/MSP. Part of the problem is when you Google this question you often get conflicting or incomplete information, so we’re going to simplify this now. First, let’s break out the acronyms:

- ISO = Independent Sales Organization

- MSP = Member Service Provider

- PSP = Payment Service Provider

- PayFac = Payment Facilitator

The underlying role that these fill for a business is to provide merchant services, and you can read our reviews of various merchant service providers here. But how that looks can be very different. So let’s clear that up now.

Independent Sales Organizations (ISO) / Member Service Providers (MSP)

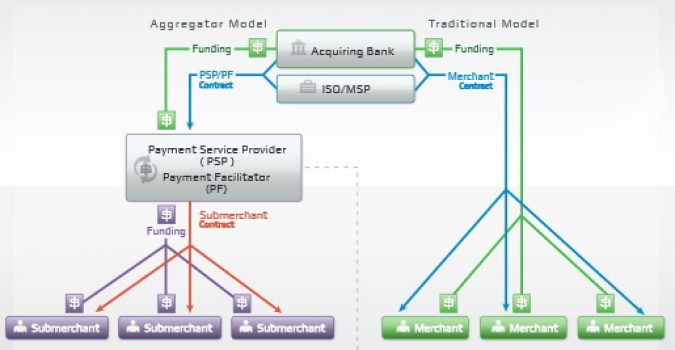

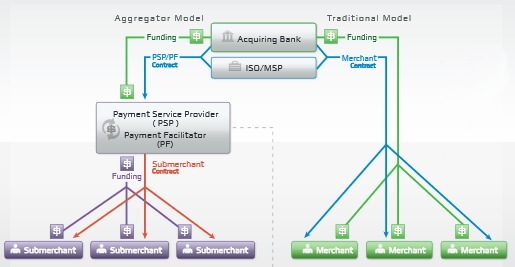

Since these all have different names, many people think they are different things, but that isn’t always the case. An ISO and an MSP are effectively the same thing. ISO is the term used by Visa to describe their approved merchant account providers, and MSP is the term used by MasterCard to describe their approved merchant account providers. The process to become an approved merchant account provider is pretty much the same with Visa and MasterCard, but merchant account providers are required to apply separately with each payment network and almost all merchant account providers do apply for both and so you will see at the bottom of their website “Approved ISO/MSP of [Some Large Financial Institution]”. That “large financial institution” (think Wells Fargo, Chase Bank, etc) is what’s referred to as the Acquirer, and the merchant doesn’t deal directly with them, but the ISO/MSP does.

Technically, a merchant account provider could apply for only one of those and would then be either an ISO or an MSP, but then they would only be able to offer merchant services to one payment network or the other, and the business that signs up with that merchant account provider would only be able to accept either Visa or MasterCard in their business transactions – depending on whether they are a registered ISO or an MSP respectively. For obvious reasons, this is exceedingly rare.

The ISO/MSP then provides the merchant account to the business, so that they can accept credit/debit cards. They also offer a customer service role on top of that, so that when the business has issues with their payment processing hardware or software, or really anything – they have someone to call. The Acquirer bank that underwrites the payments isn’t going to help. Visa and MasterCard certainly aren’t going to help. So this is where the business turns when they need help with processing payments. In addition to the customer service role, a good ISO/MSP generally provides some useful software for the merchant to make the entire process of managing payments easier.

*One special note to make is the acronym MSP can be particularly confusing since it means two different things in the payments space. Generally if you see the acronym it is referring to Member Service Provider, which is what we defined above and refers to a MasterCard approved Merchant Service Provider. Which leads us to the other MSP – Merchant Service Provider. This is a much broader term and usually isn’t seen as an acronym. It’s just an umbrella term that includes MSP’s, ISO’s and PSP’s. If you see the acronym MSP, look to the context it’s used it for clarification.

Payment Service Provider (PSP) / Payment Facilitator (PayFac)

Payment Service Providers sometimes referred to as Payment Facilitators are a different beast from ISO/MSP’s. The key functional difference between an ISO/MSP and a PSP/PayFac is that you get your own merchant account with an ISO/MSP, and you don’t with a PSP/PayFac. Just as there is no real functional difference between an ISO/MSP, there is not much difference between a Payment Service Provider and a Payment Facilitator. Not to get too far into the weeds, but some of these offer different services bundled together and play a slightly different role than other PSP’s and some even have their own internal merchant account provisioning. But they are effectively the same in that you don’t get your own merchant account. And this makes a difference for several reasons, when it comes to the pros and cons of using a ISO/MSP vs. a PSP/PayFac.

The biggest downside to using a PSP is cost. Generally speaking, you will pay more to use a PSP/PayFac than you will with an ISO/MSP. They will tell you that this additional cost is worth it because of the ease of use and approval etc., and depending on your business revenue they may be right. Some merchants don’t want the headache of getting approved by an ISO/MSP and are more than happy to pay a little extra for the convenience offered by a good PSP.

Another downside is they are generally quicker to freeze funds or terminate an account if they feel you are a risk. If you understand how a PSP works, this makes sense. After all, you don’t have your own merchant account, you’re using the same one as everyone else so if you are processing high risk payments you put all of their clients at risk. The acquiring bank could shut their merchant account down just because your payments are mixed with everyone else. Paypal, who originated this Payment Facilitator model was notorious for being quick to freeze funds.

There are advantages to going with a PSP however. The biggest advantage is you will get approved far quicker, and in some cases immediately. There is no paperwork involved, and no separate bank accounts with all the headaches involved with that. Also, many PSP’s/Payfac’s offer better integration with online businesses, as the payment gateway tends to be seamlessly bundled in. Finally, web developers much prefer PSP’s since the documentation to use them tends to be better than with many ISO/MSP’s. Some of the largest PSP’s such as Stripe, Square and PayPal are widely used due to this familiarity.

The general rule of thumb is to use a PSP if you are processing less than a million dollars per year, and an ISO/MSP if you are processing more than a million.

A Final Note on ISO/MSP’s and Payment Facilitators

If you’re unsure of the role that a merchant service provider is taking while doing your research, keep in mind that ISO/MSP’s are legally required to list their relationship to the acquiring bank on their website, generally in the footer. If you don’t see this disclosure, then you are likely looking at a payment facilitator. You can also review the current approved VISA ISO’s here and the approved MasterCard MSP’s here. MasterCard also provides a handy list of approved Payment Facilitators here.