Choosing the Best Hardware & Software to Process Payments

Before we get into the differences between the various hardware and software options, keep in mind that there are strong government regulations in place that they must follow to transmit payments electronically. You don’t need to worry about the details, just know that the industry is regulated. Now, there are three main types of “machines” for processing payments at the point of sale, which just refers to the type of payment processing hardware that you use. These include credit card machines, credit card readers, and virtual terminals.

Credit Card Machines

Also known as a payment terminal, these are what most businesses use to process credit and debit card transactions in-person. Credit card machines use a connection via phone or internet to transmit the transaction details for card-present transactions that are swiped, keyed-in or dipped in the chip card reader.

You’ll often see these function as a Point of Sale (POS) by themselves or connected to a tablet or computer with POS software installed separately. You can also connect peripherals such as PIN pads and Near-Field Communication (NFC) readers for accepting “contactless payments” such as Android or Apple Pay, although many newer machines have those built in.

– So how much do credit card machines cost? Normally credit card machines start out around $150-$200 for basic versions and go up from there. If you need a wireless version expect to pay north of $500.

– How about leasing a credit card machine? Much like leasing a router from your ISP, leasing a credit card machine is almost never a financially smart decisions as you will end up paying thousands of dollars for something you could have had for a couple hundred bucks. Don’t do it.

– Is renting a credit card machine a bad idea? Not as bad as leasing, since you’re paying month-to month and can cancel at any time. If you’re looking for a quick, cheap temporary solution then it might make sense to rent early on. Just make sure you can cancel at any time without a penalty.

– So what’s the scam about “free terminals”? It’s not necessarily a scam, but what they generally do is sign you up for some other monthly membership for services that your business may or may not find value in. Proceed with caution, and do your homework on the company offering the “free terminal”.

– Will the terminal process payments from Apple Pay, Android Pay and other NFC payment types? That depends on the terminal you use. Newer ones will almost always have that ability built-in whereas older or more basic models might require a separate peripheral device to accept those types of payments.

– Does the credit card terminal include POS software? This also depends on the terminal. Some businesses may not even need POS software, but we always recommend it. Keep in mind, good POS software will help you manage your inventory, manage your staff, implement loyalty programs, and access advanced analytics on your sales.

Credit Card Readers

A credit card reader cannot function on its own like a credit card machine/terminal can. These are the little card readers you see connected to your plumbers’ smartphone or the tablet at the bagel shop. Normally the basic card readers are provided free by your payment processing company, although you can get one with all the bells and whistles for under $100.

Virtual Terminals

If you don’t have the need to process payments in person, then you don’t need a credit card machine or reader. You can punch in the details of phone orders/mail orders via virtual terminal as long as you have an internet connection. These either run as a standalone application on your computer or smartphone, or more often you just access a login url in your web browser and process payments right in the browser window from any connected device.

This guy may or may not be making it rain due to his very smart payment processing hardware and software choices.

Mobile Payment Processing

There really isn’t much difference when it comes to mobile payment processing, it’s basically just marketing. Any merchant account or payment service provider is going to give you the ability to process mobile payments by default.

That being said, there are some providers who claim to focus on mobile and may offer a suite of products and services that fit your business needs better than a more traditional merchant account provider would. Just be sure to look over the rates and fees to ensure you’re not getting ripped off with unnecessary up-charges.

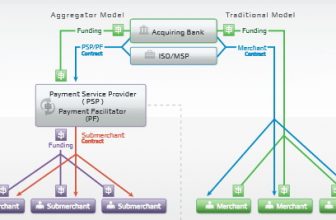

Payment Gateways

If you run an eCommerce business or if you process payments online you will need a payment gateway. A payment gateway is the software that sits between the shopping cart on your website and the bank that processes the credit card transactions. It functions by securely transmitting sensitive credit card data from an online payment form to a payment processor. It also allows you to not have to store that sensitive data on your website where it could be easily hacked.

In addition to the basic shopping cart functionality that it provides behind the scenes, a payment gateway also supports things like recurring billing and virtual terminals in case you need to punch in the occasional phone order.

How to Use Payment Gateways

Using a payment gateway is generally pretty easy to set up if you use a popular shopping cart solution like Shopify, Magento, BigCommerce, etc. Normally you just connect the gateway with the shopping cart by punching in a secret key in the backend of the website. If you have really unusual needs or if you’re using an ancient cart on your website then you might need to hire a programmer to do the integration, but for most people it’s a simple set up.

Payment Gateway Compatibility with Payment Processors

Not all payment gateways integrate with all payment processors, but most do. Again, as long as you’re not using some really oddball payment gateway then in all likelihood it will easily integrate with all major credit card processors. Even most smaller merchant account providers are actually using one of the major payment processors behind the scenes anyways so you should be good to go.

Some hybrid solutions exist where the payment gateway and the payment service provider are bundled together, such as with Stripe. If you’re using one of these companies to process payments you are forced to use their gateway since it is built into the product. Some people like this since it is one less thing to worry about, other people prefer to have a more customized solution that fits their needs.

Payment Gateway Costs

Some payment gateways require a set-up fee and/or monthly ongoing fees. They also will generally get a little piece of each transaction with what they call an authorization fee. Refer back to our rates and fees breakdown to determine your true cost when you’re price shopping.

So there you go, if you’ve read through the entire 5-part series you are more knowledgeable on the subject of payment processing than 99% of the population. Now go forth and prosper!